Overview

One key area of stormwater utility implementation is establishing the billing process for the fee. The majority of utilities uses their Geographic Information System (GIS) to process and maintain which properties are billed, for how much, and other pertinent information. GIS, if used to establish the utility fee, has proven to be a helpful integration with a utility billing system as it will typically already contain necessary information to provide with billing. Regardless of the source, the following information is suggested to be provided on the stormwater utility bill:

- Occupant

- Owner

- Service address

- Property address

- Customer type

- Impervious area

- Parcel ID number

- ERU, Runoff Coefficient, etc (dependent on fee structure)

- User fee

- Account number

- Contact information for customer service staff to answer questions

Billing System Options and Examples

Existing Utility Billing System

There are several different options for establishing a billing system. The most common is to use an existing utility billing system to including the stormwater utility bill on, such as water or wastewater. Approximately 78% of stormwater utilities include their stormwater bill on another utility bill (Black & Veatch, 2021). By having the utilities integrated, it can help make it clear to customers that a stormwater utility fee is in fact a fee, not a tax. It operates the same as other utilities, charging based on a customer’s contribution to the system. Another advantage with this method is that delinquencies are low.

For Connecticut, here is a list of each water company being used for each municipality. One area of consideration with this method is if the stormwater utility is on an individual municipal scale or a regional scale. If the water supply utility in your municipality serves more than just your municipality, a regional approach to the stormwater utility may want to be considered.

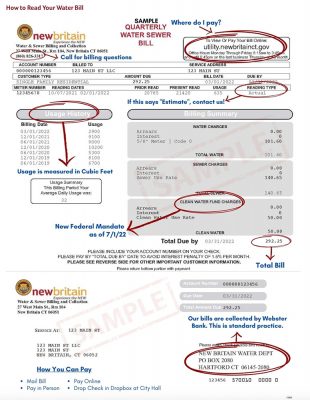

Example: New Britain, CT

New Britain’s stormwater utility, named the ‘Clean Water Fund’, was implemented in 2022. The stormwater utility bill is sent out as a separate line included on the quarterly water bill sent out by the Water & Sewer Billing and Collection of New Britain. On the city’s website, a breakdown of how to read your bill is provided:

Tax Bill

Billing can also be included with tax bills. Approximately 15% of stormwater utilities use this method (Black & Veatch, 2021). While it does demonstrate a direct link to the property in question, be cautious of having the utility fee look like a tax. A common misconception with stormwater utilities is that they are a ‘rain tax’. However, these utilities charge based on amount of impervious cover and include charges to tax-exempt properties. Another disadvantage is that tax bills are typically only mailed once a year, therefore, the stormwater utility fee will be on an annual rate.

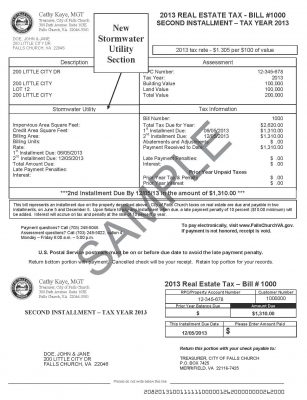

Example: Falls Church, VA

Falls Church mails out their real estate tax bill every November. On the bill is a section dedicated to the property’s stormwater fee for that year:

Separate Stormwater Billing System

Approximately 3% of stormwater utilities use a separate stormwater billing system. While these systems offer a great deal of control over billing and are concise, they can be very costly and more difficult to enforce.

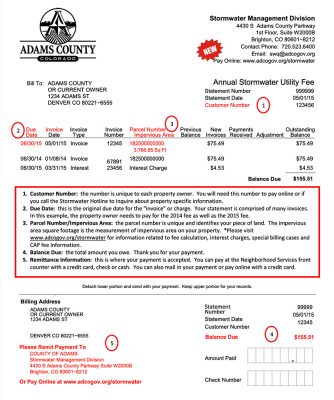

Example: Adams County, CO

Implemented in 2012, Adams County uses a separate billing system to administer its stormwater fee. This fee can be paid online, by phone, by mail, or in person. It is an annual fee mailed to each property included in the utility:

Customer Service

Having a specialized customer service workforce available can assist with billing trouble or questions specifically related to stormwater utilities. 69% of stormwater utilities fund their customer service sectors with the raised funds from the utility itself. In order to ensure a smooth transition into an established stormwater utility, information and education may want to be available to customers prior to the first billing. Various resources can be found here. In addition, the contact for customer service should also be provided with each bill for customer use if needed.

Enforcement

The House Bill 6441 permitting stormwater utilities within Connecticut allows for enforcement measures to be taken up by those in charge of the program. Municipal regulation can be adopted to implement the program with necessary measures. In addition, any fee that has not been paid in fill on or before 30 days since being billed will acquire the same interest rates as provided with delinquent taxes. Any fee which remains unpaid in full, along with accrued interest, is subject to a lien on the property. On the other hand, any customer of a stormwater utility within the state is allowed the same rights for an appeal and relief as taxpayers.

Fee Increases

One advantage of stormwater utilities is that the fee can be adjusted and tailored to current stormwater needs. Should more funding be necessary, increases to the fee can take place. According to Black and Veatch, 69% of stormwater utilities have increased their fee within the last 5 years.